If Americans only understood the corruption surrounding money, and the enormous greed in the financial sector of the American economy, they would understand how money is being stolen from them and other Americans not just by sleight of hand, but also by out-in-the-open greed.

The first thing to understand is that, for the most part, the current economy only benefits the financial classes now. When financial numbers are quoted, like the average income of Americans, that number is skewed by the fact any increase in average income is 90% comprised of gains by the upper 1% or 10% of the population.

Americans’ paychecks are bigger in dollars than 40 years ago, but their purchasing power has hardly risen at all. The wages of the lowest tenth of American workers have gained just ~3% since 2000 while the highest tenth rose 15.7%.

Trillions of dollars redistributed to the wealthy

Economists at the Rand Corporation estimate the bottom 90% of wage earners comprise less and less of the nation’s Gross Domestic Product (GDP), while the top 5% have doubled their wealth. Nearly $50 trillion (~$2.5 trillion per year) has been redistributed from the bottom 90% of income earners to the top 1% since the mid-1970s.

Not like Henry Ford

This was not like Henry Ford who in 1914 chose to increase the pay of his own workers so they could buy one of his cars!!

As an aside, you might be interested in what Henry Ford required of his workers to get that pay raise. Ford workers were given pay raises conditional upon them abstaining from alcohol, not taking in boarders, keeping their homes clean and making contributions to their savings accounts. Imagine.

Enter the whistleblower

David Stockman, former director of the Office of Management & Budget during the Reagan Administration, is one of the few insiders who tells you how the economy is rigged for those at the top. Stockman condemns an insidious practice, stock buy-backs.

Stockman says Fortune 500 companies no longer run commercial enterprises; their CEOs are in the stock-rigging game, strip-mining their own companies via endless stock buybacks to give the appearance of growth.

Stock buybacks

While executives at large companies were lured into bringing back profits from overseas by a cut in corporate taxes from 35% to 21%, they took those extra earnings and bought-back stocks from their own shareholders, driving up the price of their own equities instead of bringing home overseas profits to start new ventures and hire more Americans.

In other words, CEOs at billion-dollar companies double-crossed the American public. Stock buy-backs are now common.

In Japan, corporations there get other multi-billion-yen companies to buy each other’s stocks, a practice called Keiretsu, creating false demand and higher stock values. But here in America, stock buy-backs reign.

The egregious example of Wells Fargo

For example, Wells Fargo bank executives went so far as to churn bogus new savings accounts (accounts opened without a customer’s consent) to buoy their stock and then used false profits to buy back stocks. Someone should have seen jail time for that. Instead, a $3 billion fine was levied. And Wells Fargo is still in the stock buy-back business.

WF then increased dividends to its stock holders — people of wealth and company executives. WF just bought back $18-billion of its stock with plans to double dividends to its shareholders.

Wells Fargo is no longer in the business of lending money so Americans can buy a new homes or automobiles, it is passing money from its left hand to its right hand and keeping the gains inside its own crowd. And Wells Fargo is not alone in that practice.

In this manner, Wall Street stock markets then look rosy, but the average American only has lottery tickets to buy in a desperate and futile attempt to get ahead financially.

Cut expenses (jobs) to churn profits and blame it on Covid

Under the guise of reducing expenses related to the COVID-19 lockdown, Wells Fargo just laid off 6,400 American workers at the end of 2020 and shifted some of them to India. Any bank can cut overhead by laying off workers to produce stronger profits like WF is doing, but that is the mark of a dying company. And there are more layoffs planned. We’re talking 50,000 to 60,000 jobs, gone!

Using the COVID lockdowns as an excuse, America’s biggest companies are flourishing during the pandemic while putting thousands of people out of work. They then turned their profits over to shareholders in dividends, says a report in The Washington Post.

Real value and wealth don’t exist because of financialization

Gone are the days of creating wealth by value-added entrepreneurship, by taking steel, glass and rubber and turning it into something more valuable, like an automobile. Today every major corporation is making more money via financialization than their core business.

America has ended up with rich companies

and a poor country

In this manner, wealth flows to the top. America has ended up with rich companies and a poor country. Hardly anybody benefits from these new billion-dollar valued high-tech companies except corporate management and shareholders. These companies invest in financial assets that selfishly benefit themselves rather than productive assets that benefit society. This has all been made possible by something called financialization.

If your kids go to college and have the idea that is how to increase their personal worth, unless they enter the ranks of the financial classes, they are not likely to see their diplomas pay off.

The insane Federal Funds Rate

Let’s examine another insane practice in money and banking.

Back to David Stockman. He informs us about the Federal Funds Rate. What is that? Not even 1% of Americans could tell you.

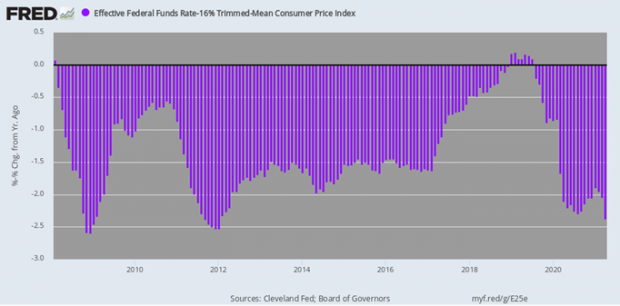

You can see by the chart Stockman provides below, the rate which banks borrow money from each other is negative and has been negative 96% of the time. Banks are borrowing overnight funds in inter-bank loans, money needed for to meet their operational requirements, at -2.37% interest.

Negative interest rates are intended to keep money from being parked in banks and not growing the economy.

(Don’t be too concerned for the banksters, the FEDERAL RESERVE BANK has spared them of this negative interest rate by something called reverse repos. See below.)

Real Federal Funds Rate, 2008–2021

The reason why banks borrow from each other is there are/were reserve requirements. If a bank has, let’s say, $70 million of financial liabilities it must have/used to have 3% of that total in reserves. If banks close the business day short of that reserve requirement, they borrowed from other banks. That was before reverse repos.

Well, as of March of last year, those reserve requirements have been totally eliminated. Obscure news reports confirm this. Now, if a bank run starts, there are huge deposits as reserves but not set aside reserves to handle such an event.

Furthermore, the Federal Deposit Insurance Corp. (FDIC) is under its 1.41% reserve ratio that insures bank deposits because of all the CARES ACT COVID-relief money that has been deposited in banks. Financial commentators say next to nothing about this.

Prior to the $2+ trillion of bank deposits received indirectly via the CARES ACT, Americans had about $13 trillion in long-term savings accounts earning less than 1% interest while the true rate of inflation is ~9% (source: ShadowStats.com). Due to inflation, Americans are losing $1.17 trillion a year in the value of their banked money.

If a bank has excess reserves, it can lend out that money to other banks at the Federal Funds Rate. We are told when banks finish their business day short of required reserves, they can borrow money from their fellow bankers. But there are no reserve requirements now. These are or were so-called overnight loans. To be precise, the money never left the banks, it is just a book entry to comply with “reserve requirements.” Obviously, the bankers and their overseers at the FED are playing footsie.

Stockman says: “Never in a million years would participants in voluntary exchange on the free market lend money — even overnight — at a negative real rate. It defies economic logic and sanity itself.” True, but the bankers have found a way around this problem – reverse repos (read below).

CARES ACT money ends up in the banks, dousing inflation

The banking system has been flooded with money that was initially distributed to unemployed Americans or distressed businesses during the COVID lockdown, and rather than spending that money, most Americans choose to pay down their credit cards or simply stash their money in a savings account, thus indirectly raising reserves at banks and avoiding increased consumer spending which would drive up inflation (cost of goods and services).

Look at the increase in reserves banks now have (chart below). They can churn reserves, if you can call it that, without having to lend money and glean profits from loans to consumers or businesses.

Reverse Repos

Another new phenomenon are interest rates on Reverse Repos. With reserve requirements out of the way, reverse repos are when banks and money-market funds park large amounts of cash overnight at the Central Bank (The Federal Reserve) because short-term lending rates have fallen to zero or next to zero. In other words, the Fed allowed banks to hide money overnight that would have been subject to negative interest rates when borrowing from each other. Don’t you wish you had a rich uncle named Sam who could do this for you?

The FED “borrows” money (excess reserves) from its member banks overnight, using US Treasury Notes (IOUs) it has on hand as collateral, and the FED deposits this interest in the banks’ accounts the next morning. It’s a circuitous game.

By the FED pulling funds out of the banks overnight, any potential flame of inflation is, for the moment, is averted. If that money is used by the banks to fund home loans and new business ventures, inflation would surely occur. The fortunes of the banks prevail over the welfare of their depositors and the nation as a whole. Bills are being paid for the time being, but nothing is contributed to real GDP growth.

To repeat what is going on. On average, $2-4 trillion in repurchase agreements are traded each night! Financial institutions don’t want to get caught holding cash because it doesn’t pay interest or even results in negative interest rates, so banks shuttle their excess money to the FED overnight and back. This is really just a game to avoid negative interest rates imposed via interbank loans using the Fed Funds rate.

No reserves now in the event of a bank run

Traditionally the FED held bank reserves (3% required prior to March 26, 2020) in case of a banking collapse. But what do you need a 3% reserve requirement for when $2 trillion was just thrust into banks via the Payroll Protection Plan?

Under prior banking practices, when the FED accepted overnight funds from banks for safe keeping, U.S. Treasury Notes served as collateral. But U.S. Treasury Notes are nothing more than IOUs that are now counted as collateral. Do you know anyone who would pay you interest on an IOU that you are holding, or let you put money in their account overnight to avoid negative interest rates? That is how ridiculous this reverse repo game is.

The nation’s financial news press plays dumb and says nothing about this pernicious practice. No one says the reverse repo game is really a way to side-step the negative interest rates via overnight deposits and the -2.37% Fed Funds Rate. The FED exists to save banks, not the economy.

Prior to the March 26, 2020 erasure of 3% bank reserve requirements the FED paid $35 billion to its 3000 member banks, $6 billion to Reverse-Repo Counterparties in interest and remitted $55 billion to the U.S. Treasury (2019).

Payroll Protection Plan is a ruse

Under the CARES ACT, the US Treasury Department prints up new money out of thin air so Americans can pay their bills. And it makes Payroll Protection Plan loans to employers, supposedly to maintain employment during the Pandemic.

But the Payroll Protection Plan is a ruse. It pays American workers more than they were earning on their jobs. Now workers don’t want to return to their jobs unless they get paid what government essentially said was a new “minimum wage.”

But how do retailers raise prices to pay for labor under present economic circumstances? In particular, restaurants were squeezed as their seating capacity was being crimped by public health authorities at the same time workers were given incentive not to work.

When these Payroll Protection Plan loans turn to gifts, which is what they become, they are added to Treasury debt. Dare anybody call this a legitimate economy?

GDP is another fabrication

In other words, deposits at commercial banks are buoyed up by the unemployed placing their gift-money in the bank or paying down credit cards. Banks aren’t helping grow the economy by lending money for commercial construction, home or auto loans. No contribution to the GDP is taking place. And nobody sees anything wrong with this. The result is the banks can’t fail but the country can, if you can grasp that.

Someone would think there is a lunatic running the country. But the news press remains mum. Americans are clueless as to what is actually going on. The lingo used in American finance is not comprehensible by the population at large. In essence, the working class is being bought off while American small businesses are being destroyed.

Debt-based money

This final insanity is never explained to the public. How does the U.S. make money other than by just creating electronic money out of thin air? The most common way is to sell U.S. Treasury Notes.

When the U.S. trades with foreign countries, the transactions are in U.S. dollars. For example, when Americans buy cars from Japan, U.S. dollars end up in Japan in exchange for automobiles. If these dollars continue to pile up overseas, there will be fewer dollars back home to continue buying Japanese automobiles. So, the U.S. “sells” U.S. Treasury Notes (promises to pay, or IOUs) in exchange for U.S. dollars. Dollars are returned to the U.S. economy in this manner.

Auctions are held by the Federal Reserve for these U.S. Treasury Notes in order to raise money over and above what income taxes are collected. This is how the National Debt is created.

Essentially a ten-dollar Federal Reserve note is a promise to repay Japan or any other U.S. trading partner its principal + interest (~2.00%). Yes, that ten-dollar bill has no asset backing. It is debt-based money. Just how bankers have finagled to back money with debt is beyond me. How does debt become an asset? Answer: it goes through Aladdin’s lamp at the Federal Reserve. And just where does the 2% interest come from to repay when it doesn’t exist in this scheme of money-making?

Furthermore, there isn’t a chance in hell any holders of U.S. Treasury Notes will ever be repaid given that the U.S. was $26.95 trillion in debt as of Dec. 31, 2020 and had $150 trillion of unfunded future liabilities. It’s a high-stakes game of musical chairs and Monopoly.

Quandary

America is in a quandary. If Americans choose to spend their “gift” money from the Federal Government, uncontrolled inflation will surely result. Yet, if Americans choose to hold their money in the bank as they are doing now, the consumer economy, which is ~70% of America’s productivity, is forever stalled.

One might think the U.S. banking system is being set up for a collapse. The banksters have circled their wagons and protected, even enriched, themselves, while misery is spread throughout the land. When and if the globalists take over America as they intend, and usher in their digital currency to replace paper money, American banks will likely be intact while the masses beg for relief from erosion of the value of their money and seeking relief from contrived shortages of essential goods, food, water and electricity. Few Americans see all these events as precursors to a global takeover.

Unless the news media alerts Americans, what is really happening remains behind the curtains. Whoever is steering the Ship of State isn’t the Congress or the White House. So which madman is?